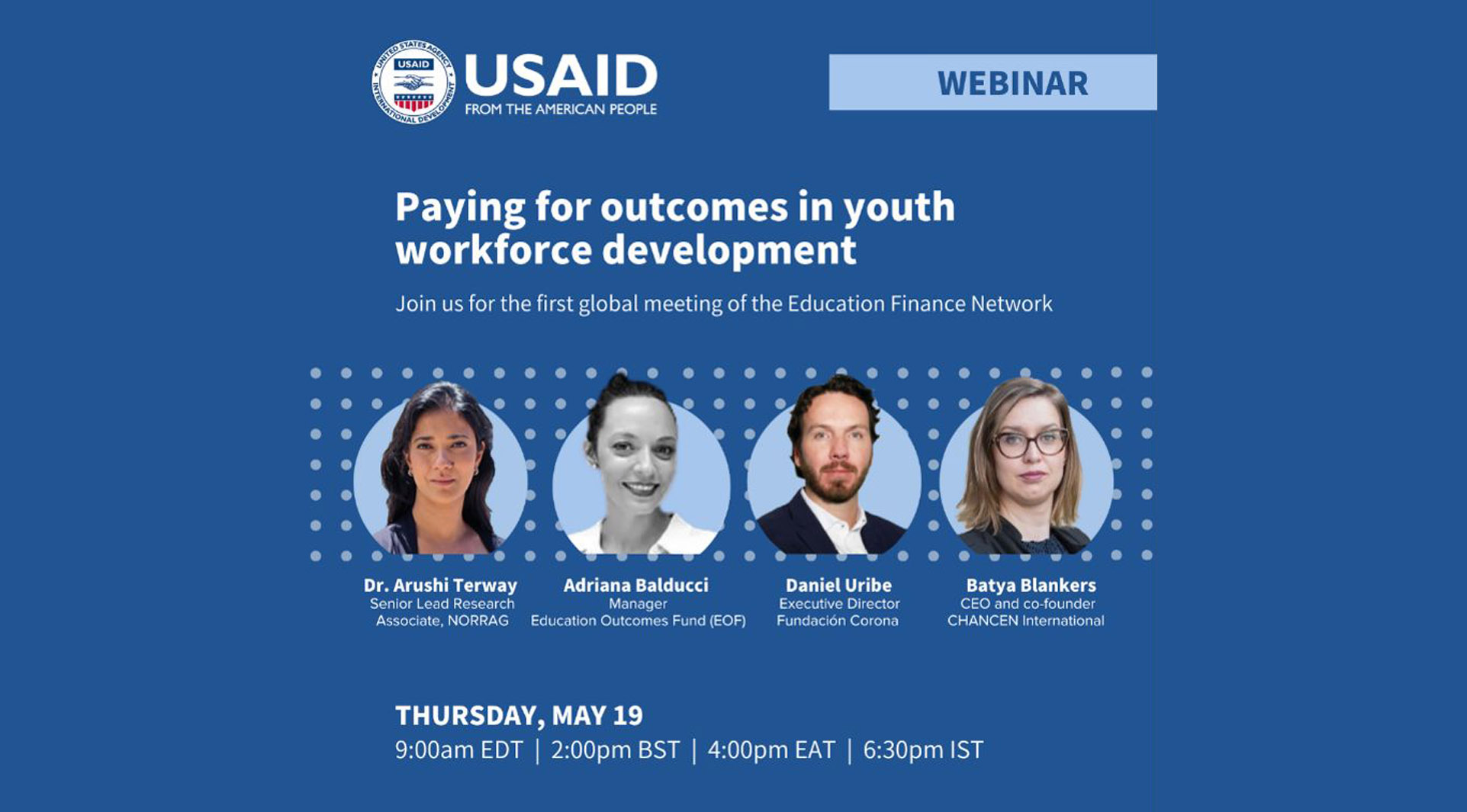

NORRAG at the Paying for outcomes in youth workforce development webinar

Dr Arushi Terway, NORRAG Senior Lead Research Associate, spoke at “Paying for outcomes in youth workforce development” a webinar hosted on 19 May 2022 by the Education Finance Network. The online conversation on Result-Based Financing (RBF) blended the evidence-based perspectives of Dr Terway with insights from industry experts who have engaged directly with RBF instruments, including Impact Bonds, Income Share Agreements and Outcome Funds. Read the event summary written by the Education Finance Network‘s team below.

Event summary

More than 100 attendees attended from around the world, including donors, researchers, impact investors, and practitioners, bringing together different backgrounds, perspectives, and varying levels of experience of Results-based Financing (RbF) instruments. Our panelists discussed existing research around the role of RbF instruments in improving outcomes in workforce development, experiences from Colombia’s first Social Impact Bond, how RbF mechanisms can incentivize inclusion of disadvantaged groups, and how Income Share Agreements help youth in sub-Saharan Africa gain employment.

Key takeaways from the session:

- RbF tools provide an opportunity for service providers to focus workforce development interventions on meaningful outcomes such as workforce entry and sustained employment.

- Experimenting with metric design, selection of beneficiaries, and risk-sharing with the service providers allows programs to adjust to regional priorities and contexts, responding to the most pressing needs and challenges of each setting.

- Further research on vocational training and educational programs, particularly in low- and middle-income countries, is needed to provide insights on the effectiveness of these instruments.

Snapshot of the discussion:

“Results-based Financing is a tool, not a panacea”

A systematic literature review by NORRAG found that only a minor portion of available research on RbF in education—and especially in vocational training—is focused on low- and middle-income countries. In addition to the limited available research on RbF in education, Arushi Terway also discussed the lack of monitoring and evaluation systems that look at the theory of change of how the financial structure itself—as opposed to the intervention being delivered—contributes to the outcome. Arushi also pointed out that RbF is not an answer for everything. As not all programs can be designed with the measurable outcomes required in RbF mechanisms, their use should be strategic based on the activity, rather than a general trend in international aid and government financing.

Experimenting with models and incentives

Empleando Futuro, the first Social Impact Bond (SIB) in a low- or middle-income country, served to test the models and incentives for future RbF programs in Colombia. Daniel Uribe explained how this SIB allowed Fundación Corona to experiment with metric design, population selection, targeting, and risk-sharing with the service provider to align incentives throughout the value chain of the program. Daniel discussed the challenges of coordinating with governments in SIBs: the lack of legal frameworks around RbF makes these types of contracts difficult to procure, and the political cycles make it problematic for governments to commit to multi-year budgets. “Many RbF programs in Latin America have failed precisely because of these barriers,” said Daniel.

How do we incentivize inclusion of disadvantaged populations in RbF programs?

When determining the target population for a project, the Education Outcomes Fund (EOF) first works with the government to understand their priorities and objectives. Once a target population has been selected, the EOF identifies the employment barriers for this group, which may include gender, education level, geography, mobility, age or impairments. EOF then identifies the barriers for providers to achieve the desired outcomes for this population. Adriana Balducci explained that only by understanding these constraints—which are highly context specific—is it possible to determine how best to incentivize inclusion of certain groups, whether through differential pricing, quotas or eligibility criteria. For example, in their programs in Ghana and Sierra Leone, EOF will pay differential pricing per outcomes to incentivize learning outcomes for girls.

“ISAs are built on the principle that no one should pay for their post-secondary education if you cannot generate meaningful income thereafter.”

Private capital fills an important gap in funding for post-secondary education, where public resources are scarce in sub-Saharan Africa. However, to enable growth in the income share agreement (ISA) market, and protect students who benefit from ISAs, Batya Blankers stated that ISA providers must be regulated to provide consumer protection and to ensure that pricing is aligned with market rates. Another important growth enabler for the ISA market is to improve financial literacy among young people, as disadvantaged students who are unfamiliar with the benefits and risks of ISAs may refrain from applying. Batya also explained how Chancen International mitigates the risk of adverse selection of borrowers by placing the risk calculation of the ISA on the quality of the education as opposed to the characteristics of the candidate.

The panel discussion was moderated by Dayoung Lee, Associate Partner at Dalberg and co-lead of the Education to Employment Practice.

Panel

- Dr Arushi Terway, Senior Lead Research Associate, NORRAG

- Adriana Balducci, Manager, Education Outcomes Fund

- Daniel Uribe, Executive Director, Fundación Corona

- Batya Blankers, CEO and co-founder, CHANCEN International

Watch the replay video of the event:

For more on NORRAG’s work on Innovative Finance for Education, check our IFE project page.